The 1099-NEC form is an essential document for businesses and independent contractors alike. It is used to report non-employee compensation, such as fees, commissions, and other income, to the Internal Revenue Service (IRS). As we enter the year 2020, it is crucial for professionals to understand the changes that have been made to this form and how to properly fill it out.

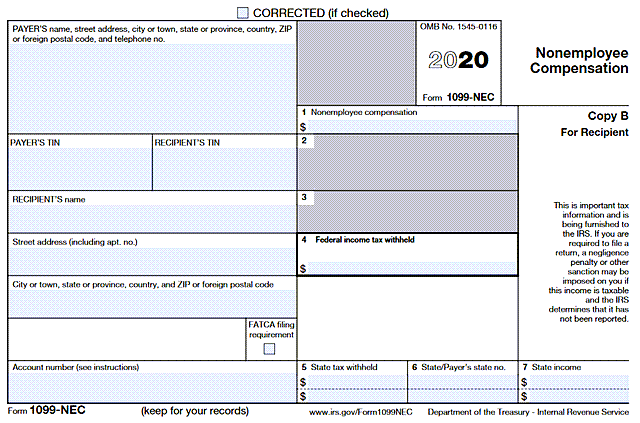

1099-NEC 2020 Sample Form - Crestwood Associates

First up, we have a sample form provided by Crestwood Associates. This image showcases what the 1099-NEC form looks like and provides a helpful visual representation for professionals who are unfamiliar with it.

First up, we have a sample form provided by Crestwood Associates. This image showcases what the 1099-NEC form looks like and provides a helpful visual representation for professionals who are unfamiliar with it.

Free Printable 1099 Nec Form 2022 - Printable Word Searches

Next, we have a printable version of the 1099-NEC form for the year 2022. This resource, created by Printable Word Searches, allows professionals to easily access and print the form for their records.

Next, we have a printable version of the 1099-NEC form for the year 2022. This resource, created by Printable Word Searches, allows professionals to easily access and print the form for their records.

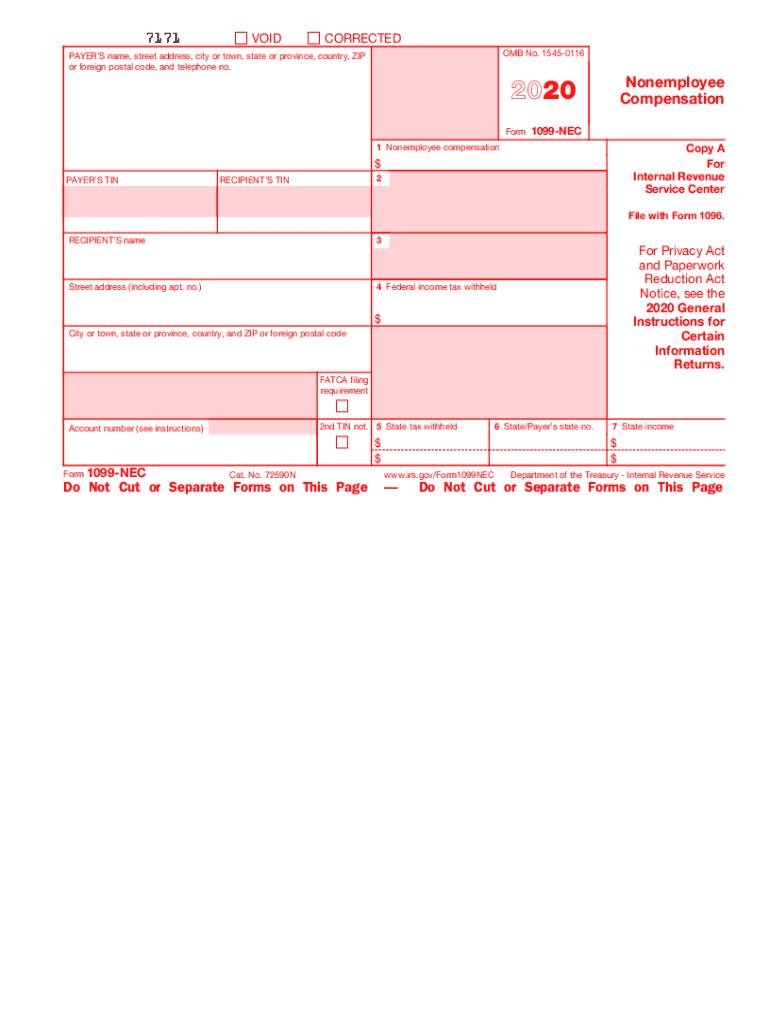

1099 Nec Form 2020 Printable - Customize and Print

Oracle provides a customizable and printable version of the 1099-NEC form for the year 2020. This resource allows professionals to input their specific information and print out a completed form.

Oracle provides a customizable and printable version of the 1099-NEC form for the year 2020. This resource allows professionals to input their specific information and print out a completed form.

What is Form 1099-NEC for Nonemployee Compensation

For those who are unfamiliar with the purpose of the 1099-NEC form, this image provides a clear explanation. It highlights that the form is used to report nonemployee compensation and explains that it has replaced the previous 1099-MISC form for this specific category.

For those who are unfamiliar with the purpose of the 1099-NEC form, this image provides a clear explanation. It highlights that the form is used to report nonemployee compensation and explains that it has replaced the previous 1099-MISC form for this specific category.

QuickBooks 1099 Tax Form Changes at 2020 Year-end

QuickBooks users will want to take note of the changes to the 1099-NEC form for the year 2020. This image provides valuable information on the adjustments that have been made and how they may impact your tax reporting process.

QuickBooks users will want to take note of the changes to the 1099-NEC form for the year 2020. This image provides valuable information on the adjustments that have been made and how they may impact your tax reporting process.

1099 Nec Printable Form - Printable Forms Free Online

For professionals seeking a printable version of the 1099-NEC form, Printable Forms Free Online offers a convenient resource. This image displays what the form looks like and allows for easy accessibility and printing.

For professionals seeking a printable version of the 1099-NEC form, Printable Forms Free Online offers a convenient resource. This image displays what the form looks like and allows for easy accessibility and printing.

Memo - For 2020, 1099-NEC Replaces 1099-MISC For (NEC) Non-Employee

This memo emphasizes the important change that has taken place in 2020, with the 1099-NEC form now replacing the 1099-MISC form for reporting non-employee compensation. It clarifies that this change specifically applies to the (NEC) category and is essential information for professionals.

This memo emphasizes the important change that has taken place in 2020, with the 1099-NEC form now replacing the 1099-MISC form for reporting non-employee compensation. It clarifies that this change specifically applies to the (NEC) category and is essential information for professionals.

Are You Ready for the 1099-NEC? | Heintzelman Accounting Services

Heintzelman Accounting Services raises an important question with this image: are you prepared for the 1099-NEC? This highlights the significance of understanding the changes that have been made and ensuring that your reporting is accurate and compliant.

Heintzelman Accounting Services raises an important question with this image: are you prepared for the 1099-NEC? This highlights the significance of understanding the changes that have been made and ensuring that your reporting is accurate and compliant.

1099 Nec Form 2020 Printable - Printable World Holiday

Printable World Holiday offers a printable version of the 1099-NEC form for the year 2020. This resource allows professionals to access and print the form for their tax reporting purposes.

Printable World Holiday offers a printable version of the 1099-NEC form for the year 2020. This resource allows professionals to access and print the form for their tax reporting purposes.

The New 1099-NEC IRS Form for Second Shooters & Independent Contractors

Finally, this image highlights the importance of the 1099-NEC form for specific professions, such as second shooters and independent contractors. It stresses the need to be aware of this form and properly report income in order to meet tax obligations.

Finally, this image highlights the importance of the 1099-NEC form for specific professions, such as second shooters and independent contractors. It stresses the need to be aware of this form and properly report income in order to meet tax obligations.

In conclusion, the 1099-NEC form is a vital document for professionals to understand and properly complete. The various resources and images provided offer valuable insights into what the form looks like, its purpose, and how it has replaced the previous 1099-MISC form for reporting non-employee compensation. By familiarizing oneself with these resources and ensuring accurate reporting, professionals can stay in compliance with IRS regulations and avoid potential penalties.