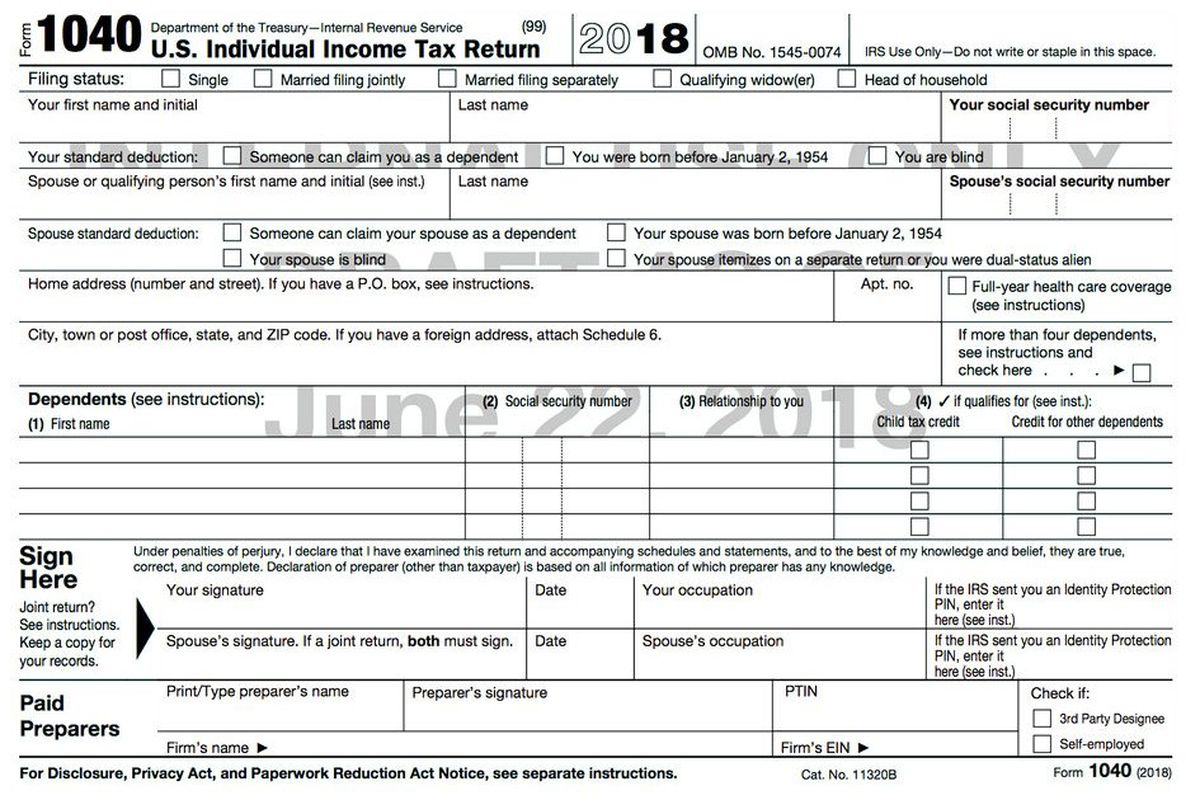

Form 1040 V Fillable - Printable Forms Free Online

Form 1040 V Fillable

Are you tired of the traditional paper tax forms? Do you want a more convenient and efficient way to file your taxes? Look no further than the Form 1040 V Fillable, a printable form that can be filled out online for free!

Are you tired of the traditional paper tax forms? Do you want a more convenient and efficient way to file your taxes? Look no further than the Form 1040 V Fillable, a printable form that can be filled out online for free!

What makes the Form 1040 V Fillable so special is its simplicity and ease of use. Gone are the days of struggling to decipher complicated tax jargon and confusing instructions. With this form, you can fill out your tax information in a straightforward and user-friendly manner.

Using this printable form is as easy as 1-2-3. Simply navigate to the website, click on the link to access the form, and start filling out the required fields. The form is designed to ensure that you provide all the necessary information to accurately calculate your tax liability.

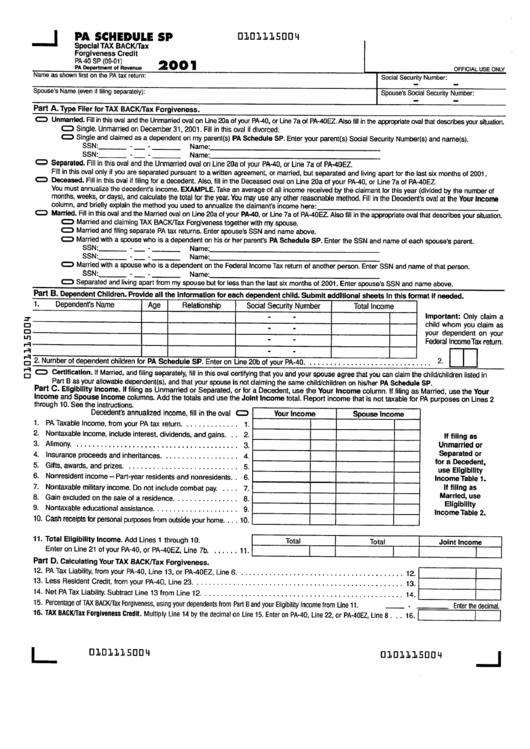

Pa 40 Tax Form Printable - Printable Forms Free Online

Pa 40 Tax Form Printable

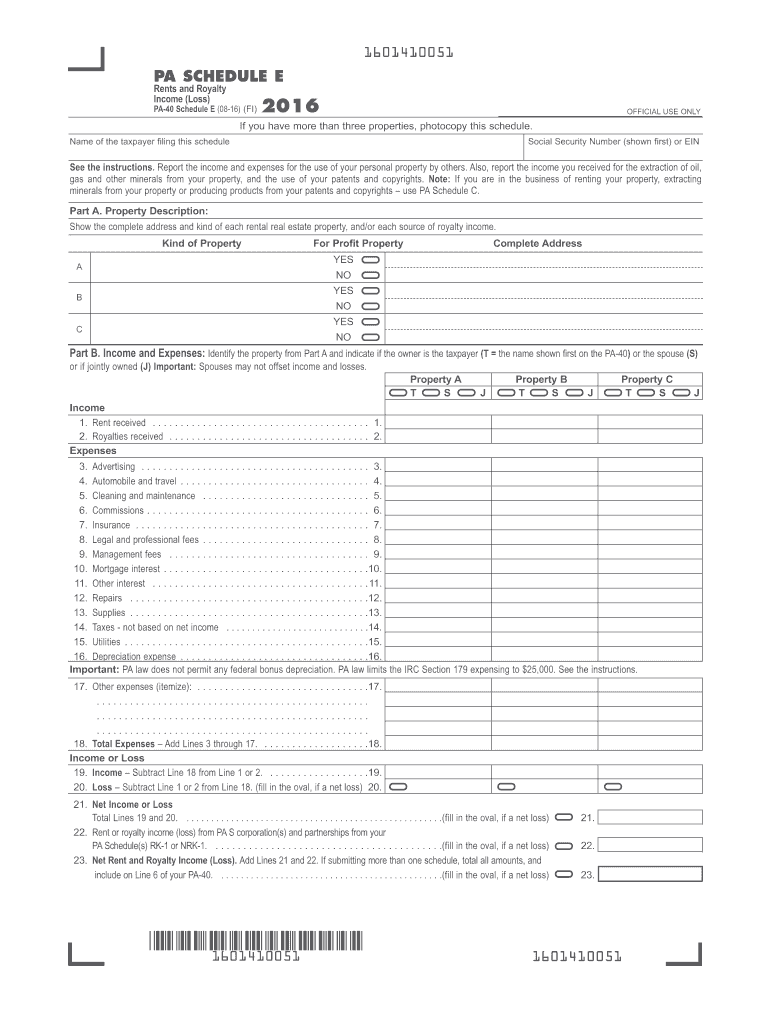

For residents of Pennsylvania, the Pa 40 Tax Form Printable is the go-to tax form for filing their state income tax returns. This form is specifically tailored to meet the needs of Pennsylvania taxpayers and streamline the tax filing process.

For residents of Pennsylvania, the Pa 40 Tax Form Printable is the go-to tax form for filing their state income tax returns. This form is specifically tailored to meet the needs of Pennsylvania taxpayers and streamline the tax filing process.

With the Pa 40 Tax Form Printable, you can easily report your income, deductions, credits, and payments. The form provides clear instructions and guidance on how to fill it out correctly, ensuring that you accurately report your tax information and avoid any mistakes that could lead to penalties or delays in processing your return.

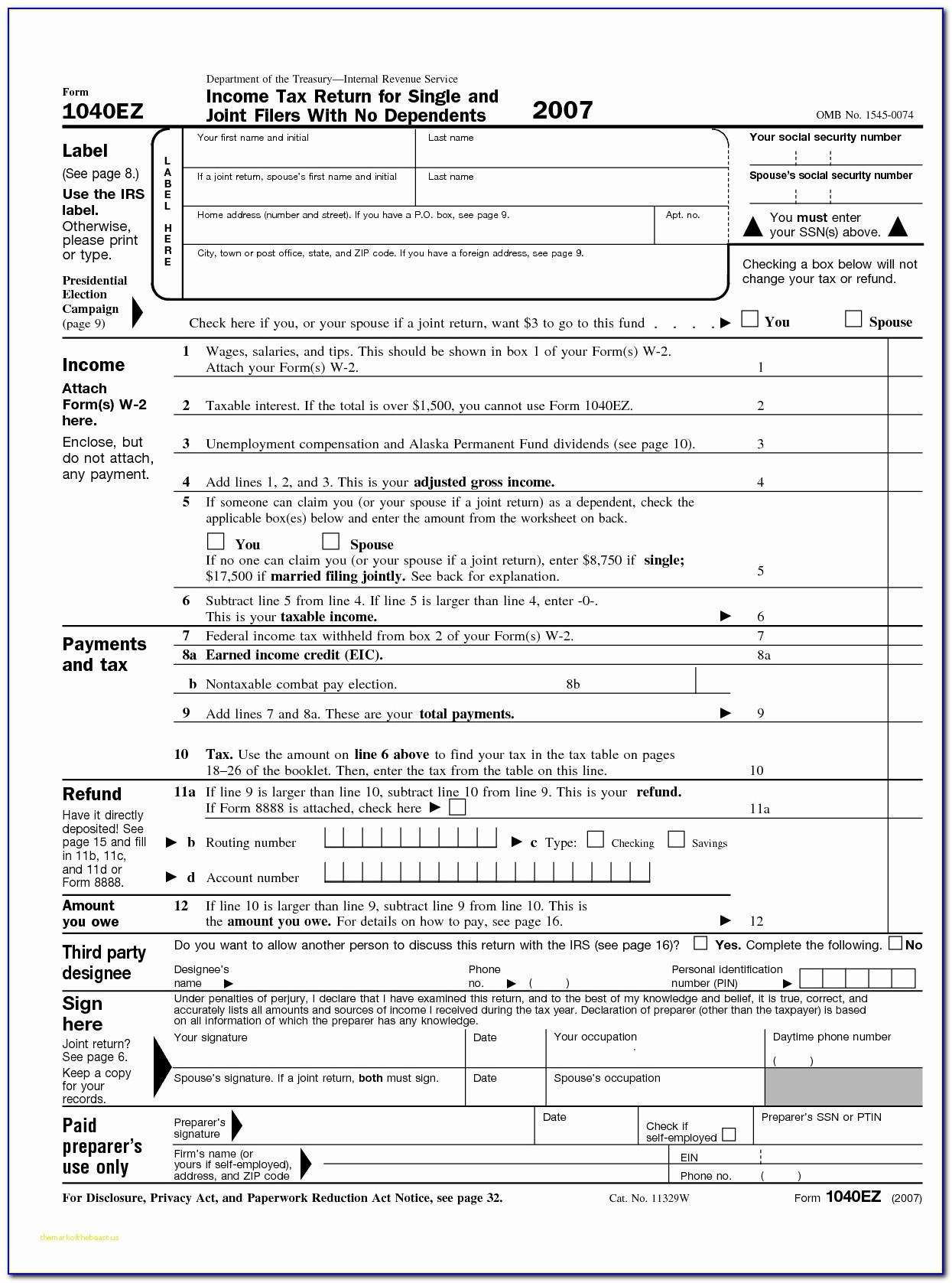

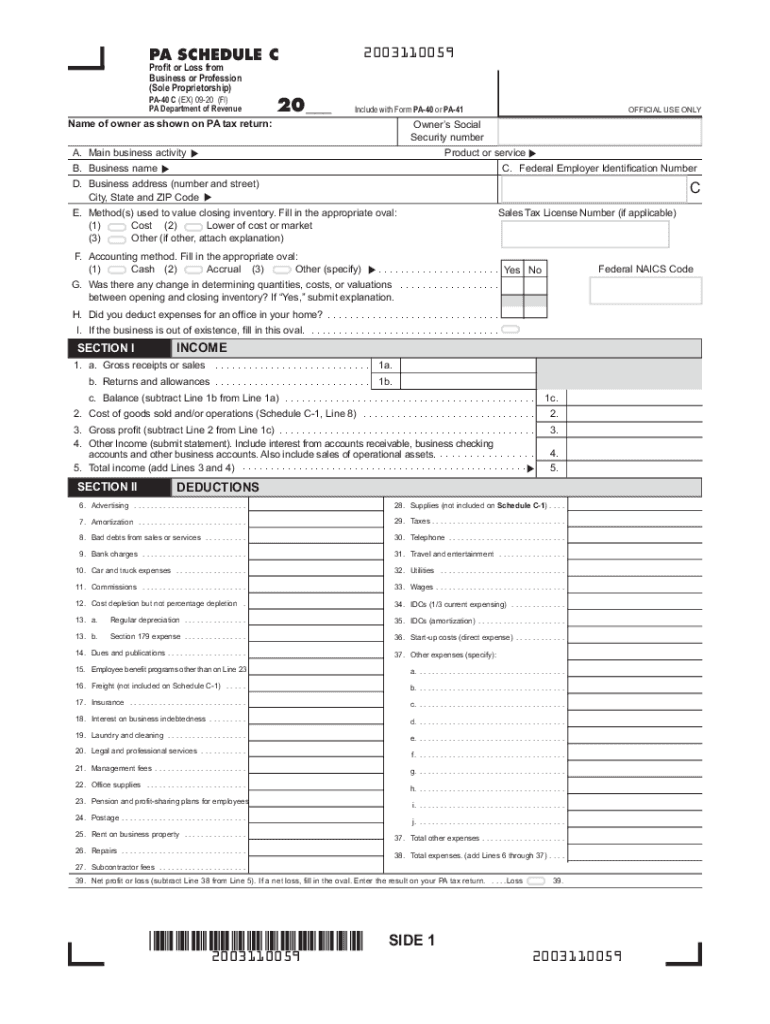

Will Printable Form - Printable Forms Free Online

Will Printable Form

Planning for the future is essential, and having a legally valid will is an important part of that planning. The Will Printable Form is a valuable tool that allows you to create a will in a simple and convenient manner.

Planning for the future is essential, and having a legally valid will is an important part of that planning. The Will Printable Form is a valuable tool that allows you to create a will in a simple and convenient manner.

Creating a will ensures that your assets and belongings are distributed according to your wishes after your passing. It also provides you with the opportunity to designate guardians for your children and specify any special instructions or requests you may have.

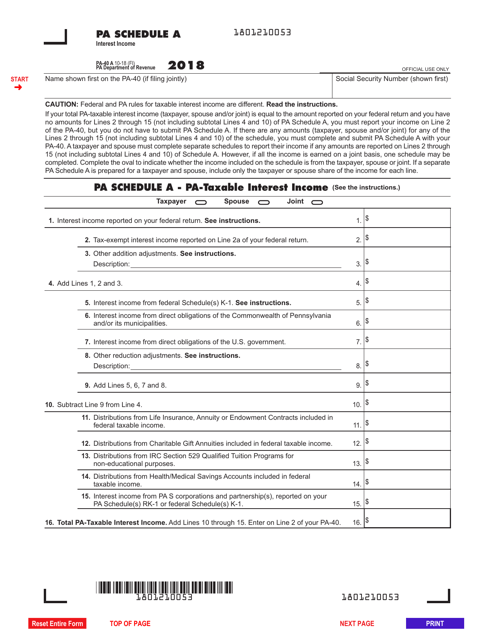

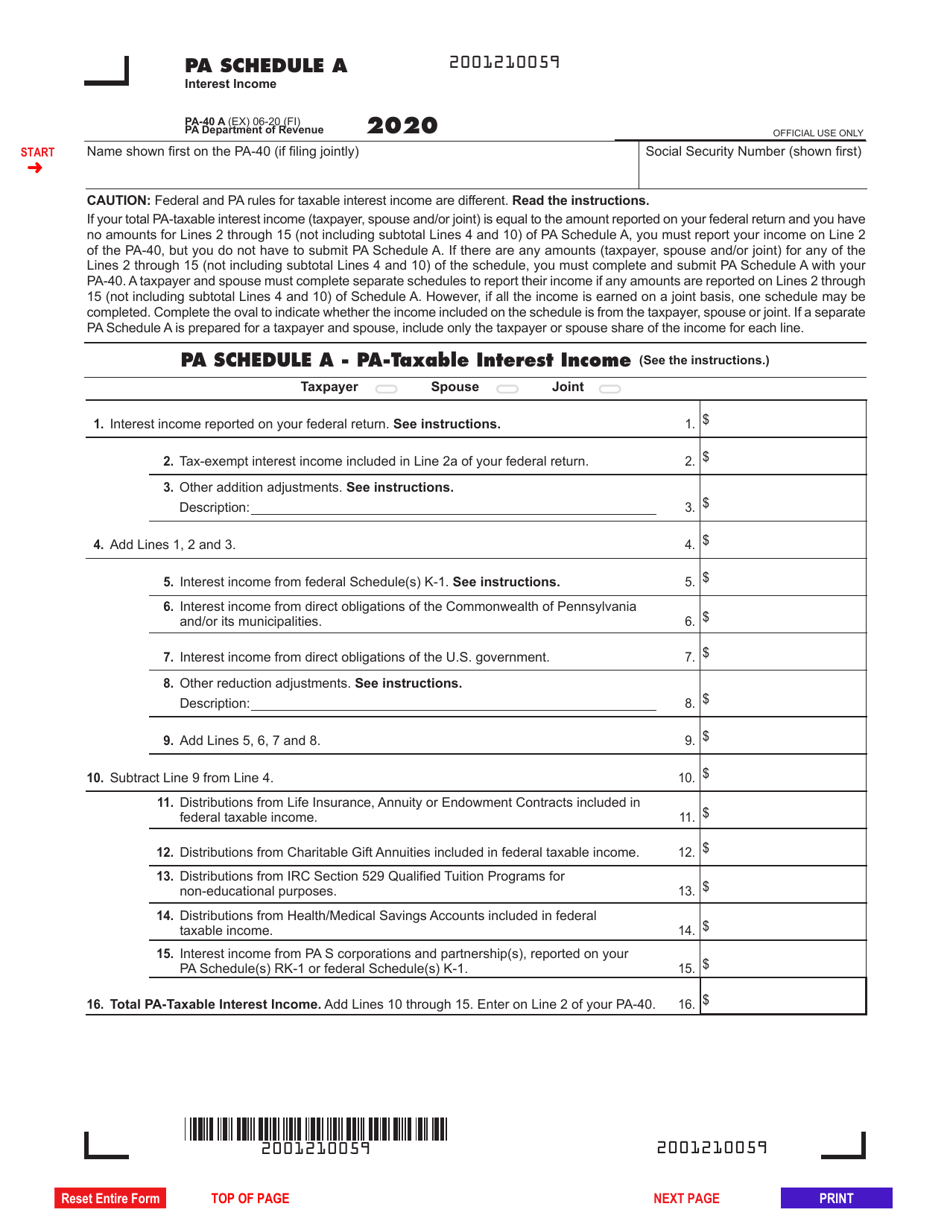

Form PA-40 Schedule A - 2018 - Fill Out, Sign Online and Download

Form PA-40 Schedule A

The Form PA-40 Schedule A is an important attachment to your Pennsylvania state income tax return. This form is used to report any interest income earned during the tax year.

The Form PA-40 Schedule A is an important attachment to your Pennsylvania state income tax return. This form is used to report any interest income earned during the tax year.

Interest income can be derived from various sources, such as bank accounts, certificates of deposit, bonds, or loans. It is essential to accurately report this income on your tax return to ensure compliance with Pennsylvania tax laws and avoid any potential penalties or audits.

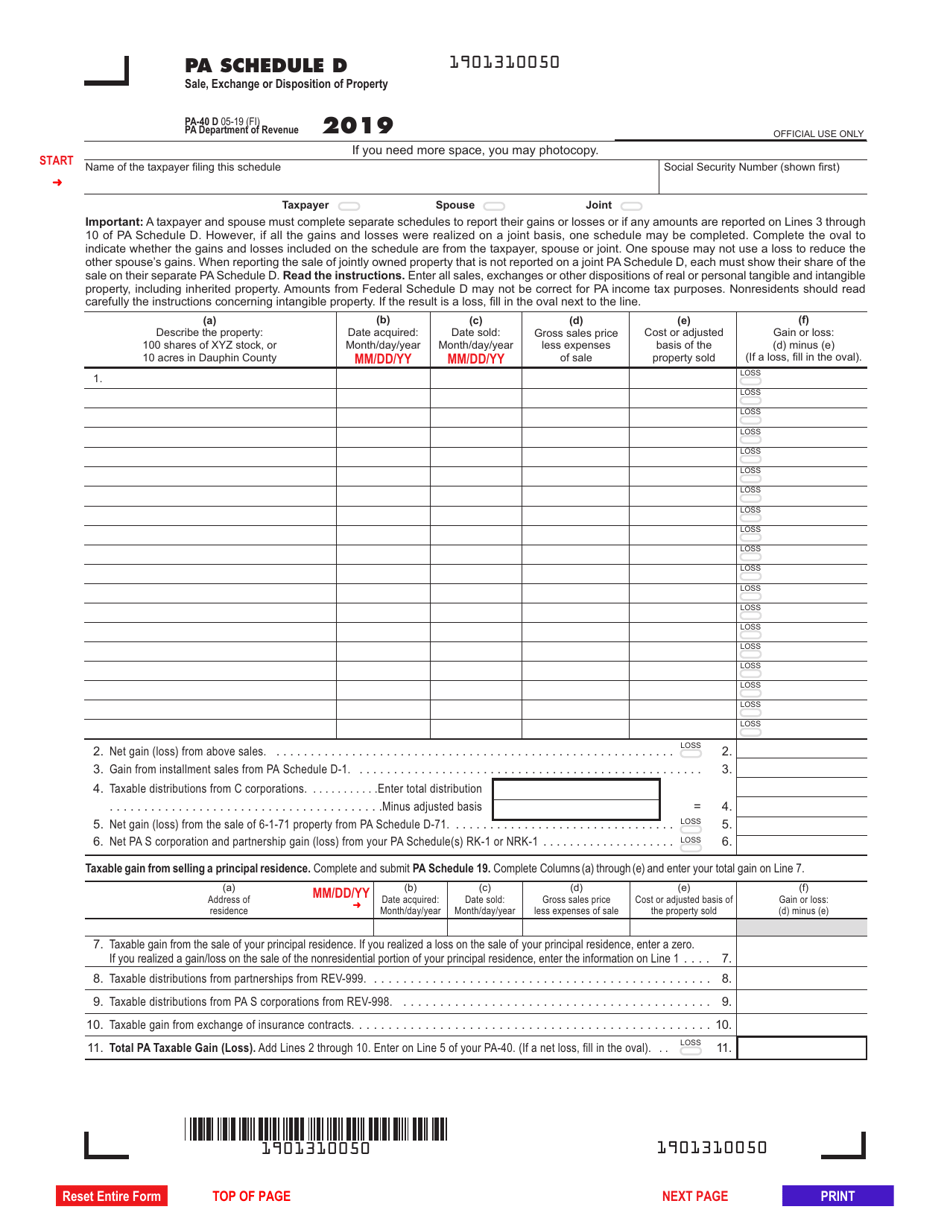

Form PA-40 Schedule D - 2019 - Fill Out, Sign Online and Download

Form PA-40 Schedule D

The Form PA-40 Schedule D is another crucial attachment to your Pennsylvania state income tax return. This form is used to report any capital gains or losses from the sale, exchange, or disposition of property.

The Form PA-40 Schedule D is another crucial attachment to your Pennsylvania state income tax return. This form is used to report any capital gains or losses from the sale, exchange, or disposition of property.

If you had any stock sales, real estate transactions, or other property sales during the tax year, it is important to report them accurately on this form. Failing to report capital gains or losses correctly could lead to IRS scrutiny and potential penalties.

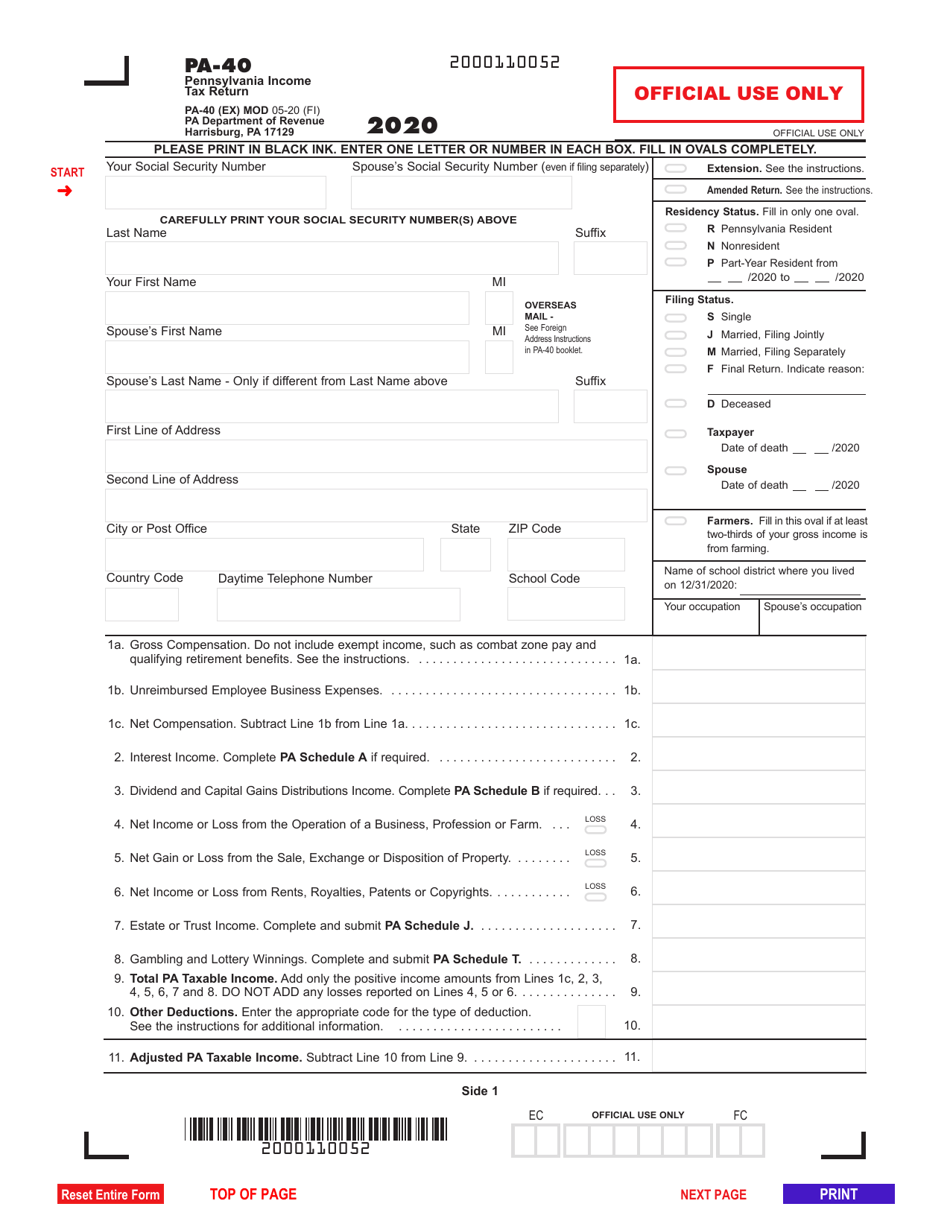

Pa 40 Tax Form Printable - Printable Forms Free Online

Pa 40 Tax Form Printable

The Pa 40 Tax Form Printable is the primary form for Pennsylvania residents to report their state income tax. This form covers a wide range of income types, deductions, and credits, allowing taxpayers to accurately report their financial information.

The Pa 40 Tax Form Printable is the primary form for Pennsylvania residents to report their state income tax. This form covers a wide range of income types, deductions, and credits, allowing taxpayers to accurately report their financial information.

By using the Pa 40 Tax Form Printable, you can ensure that you provide all the necessary information required by the Pennsylvania Department of Revenue. Failing to file your state tax return or inaccurately reporting your income could result in penalties, interest charges, or legal consequences.

2019 Pa40 From - Fill Out and Sign Printable PDF Template | signNow

2019 Pa40 Form

The 2019 Pa40 Form is a printable PDF template that allows you to conveniently fill out and sign your Pennsylvania income tax return. By using this form, you can streamline the tax filing process and ensure that you meet all the necessary requirements.

The 2019 Pa40 Form is a printable PDF template that allows you to conveniently fill out and sign your Pennsylvania income tax return. By using this form, you can streamline the tax filing process and ensure that you meet all the necessary requirements.

The 2019 Pa40 Form provides clear instructions and guidance on how to complete each section accurately. It covers various income types, deductions, and credits, ensuring that you report your tax information correctly and maximize your eligible tax benefits.

Form PA-40 Schedule A Download Fillable PDF or Fill Online Interest

Form PA-40 Schedule A

The Form PA-40 Schedule A is an important document for Pennsylvania residents with interest income to report. This fillable PDF form allows you to conveniently complete and submit your interest income details online.

The Form PA-40 Schedule A is an important document for Pennsylvania residents with interest income to report. This fillable PDF form allows you to conveniently complete and submit your interest income details online.

Whether you earned interest income from bank accounts, bonds, or other sources, it is crucial to report it accurately using the Form PA-40 Schedule A. Failing to report this income could result in penalties or further scrutiny from the Pennsylvania Department of Revenue.

2021 PA Form PA-40 ES (I) Fill Online, Printable, Fillable, Blank

2021 PA Form PA-40 ES (I)

The 2021 PA Form PA-40 ES (I) is a fillable, printable, and blank form that allows Pennsylvania taxpayers to estimate and pay their state quarterly estimated tax payments. This form is essential for individuals who anticipate owing more than $8,000 in state tax for the tax year.

The 2021 PA Form PA-40 ES (I) is a fillable, printable, and blank form that allows Pennsylvania taxpayers to estimate and pay their state quarterly estimated tax payments. This form is essential for individuals who anticipate owing more than $8,000 in state tax for the tax year.

By completing and submitting the 2021 PA Form PA-40 ES (I), you can stay on top of your tax obligations throughout the year and avoid any potential underpayment penalties. This form provides clear instructions on how to calculate your estimated tax liability and make the necessary payments.

Pennsylvania Income Tax Return PA 40 Revenue Pa Gov - Fill Out and Sign

Pennsylvania Income Tax Return PA 40

The Pennsylvania Income Tax Return PA 40 is the official form for filing your state income tax return in Pennsylvania. It is essential to accurately complete this form and submit it to the Pennsylvania Department of Revenue to fulfill your tax obligations.

The Pennsylvania Income Tax Return PA 40 is the official form for filing your state income tax return in Pennsylvania. It is essential to accurately complete this form and submit it to the Pennsylvania Department of Revenue to fulfill your tax obligations.

By filling out and signing the Pennsylvania Income Tax Return PA 40, you report your income, deductions, credits, and payments, ensuring compliance with state tax laws. Failing to file your state tax return or providing incorrect information could result in penalties or further legal consequences.