When it comes to filing your taxes, one important document that you need to be familiar with is the W-4 form. This form is used to determine the amount of tax that should be withheld from your paycheck by your employer. It’s crucial to understand how to properly fill out the W-4 form to ensure that the right amount of taxes is withheld. Let’s take a closer look at the W-4 form and the key information you need to know.

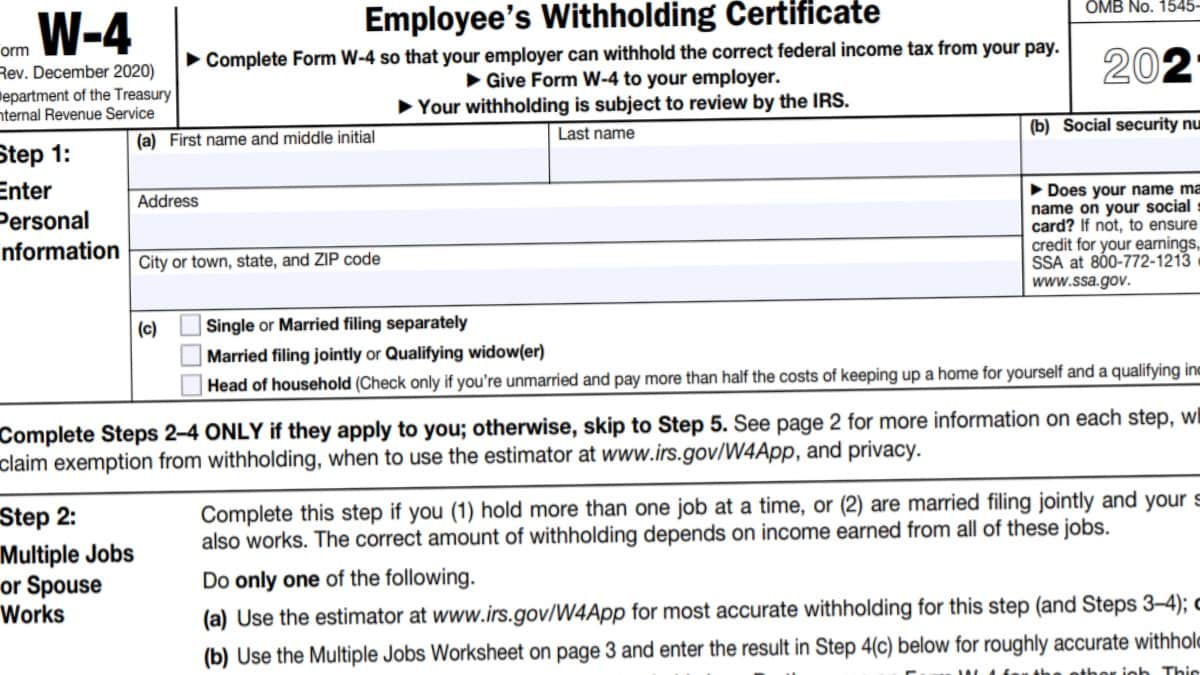

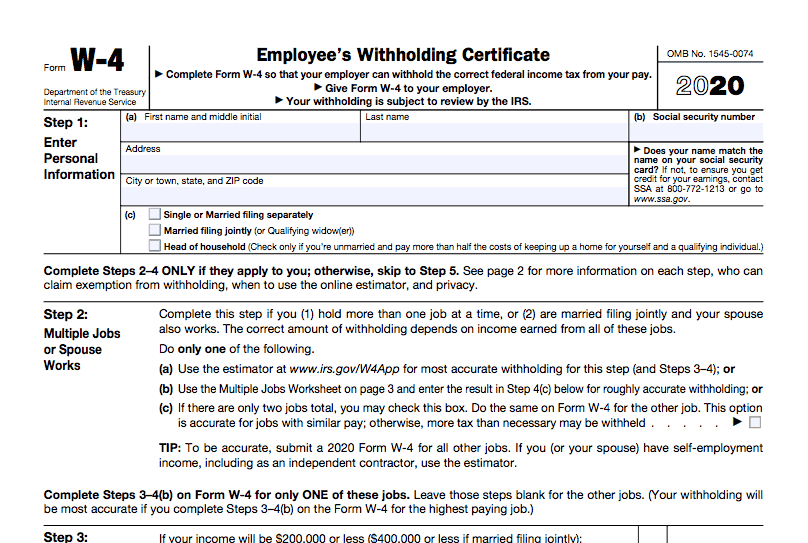

W4 Form 2020 - W-4 Forms

The W-4 form, also known as the Employee’s Withholding Certificate, is a document that you must complete and provide to your employer. It helps your employer determine the correct amount of federal income tax to withhold from your paycheck. The form asks for information such as your filing status, number of allowances, and any additional withholding amount you’d like to specify.

The W-4 form, also known as the Employee’s Withholding Certificate, is a document that you must complete and provide to your employer. It helps your employer determine the correct amount of federal income tax to withhold from your paycheck. The form asks for information such as your filing status, number of allowances, and any additional withholding amount you’d like to specify.

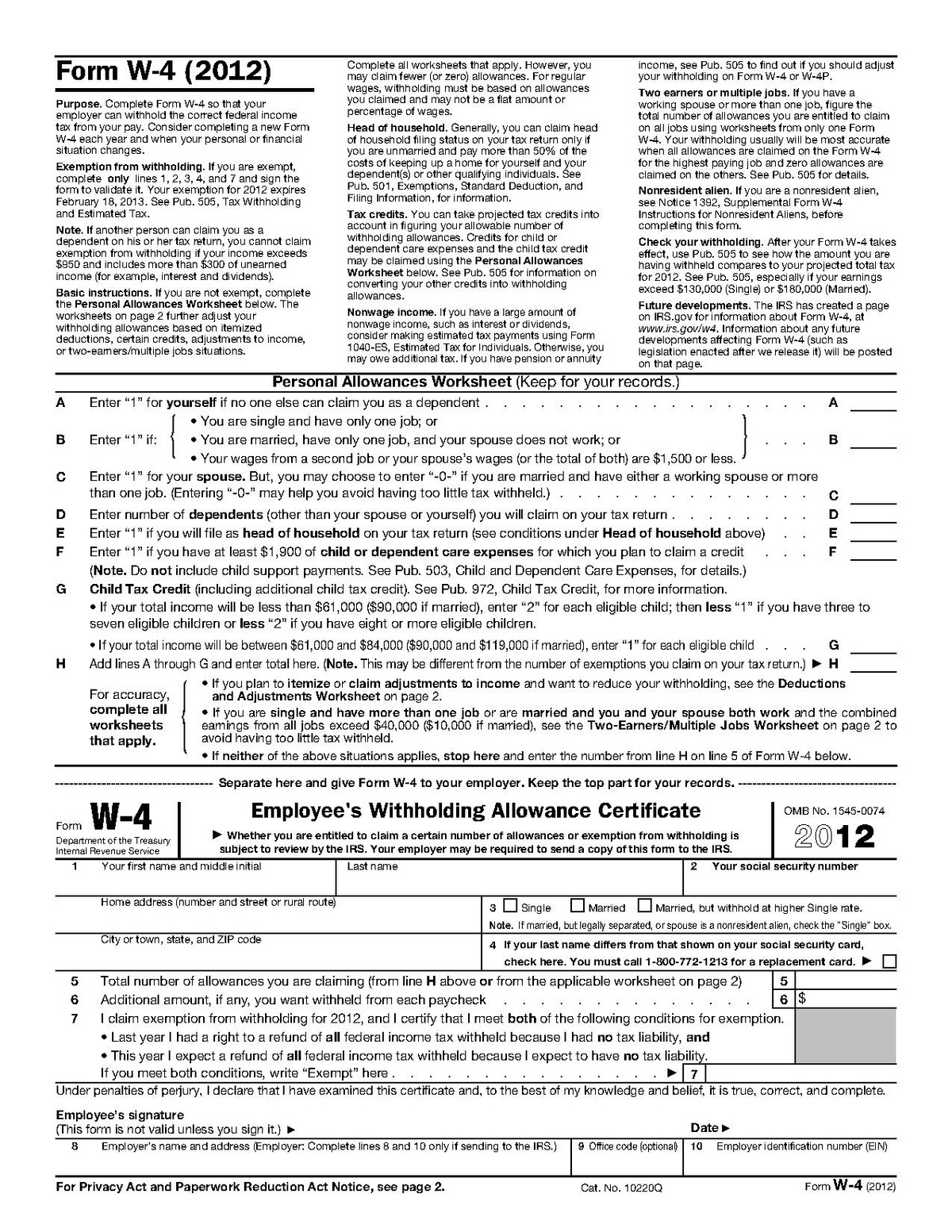

Printable Free W 4 Forms - Printable Forms Free Online

If you’re looking for a printable version of the W-4 form, you can easily find it online. Printable forms are convenient because you can fill them out at your own pace and have a copy for your records. It’s important to ensure that you are using the correct version of the W-4 form for the applicable tax year.

If you’re looking for a printable version of the W-4 form, you can easily find it online. Printable forms are convenient because you can fill them out at your own pace and have a copy for your records. It’s important to ensure that you are using the correct version of the W-4 form for the applicable tax year.

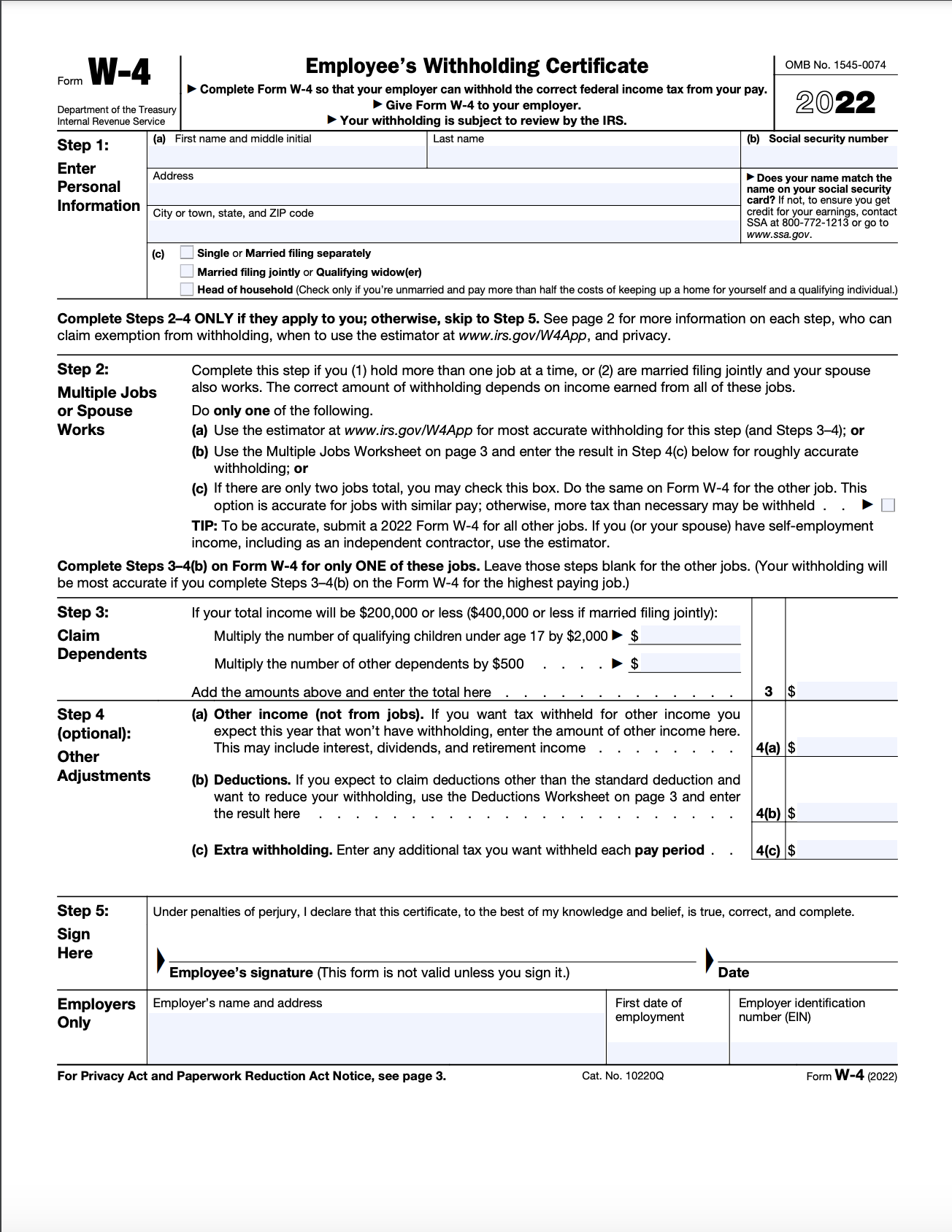

W-4 2020 Form Printable - 2022 W4 Form

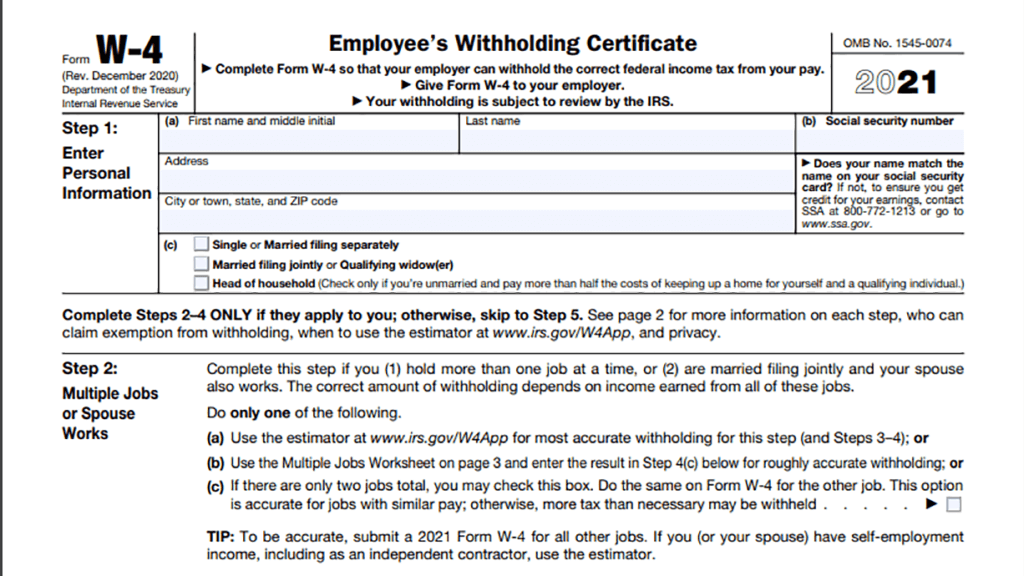

The W-4 form can vary from year to year, as tax regulations and laws change. It’s essential to use the correct version of the form for the appropriate tax year. Make sure you are aware of any updates or changes to the W-4 form for the current tax year to avoid any discrepancies or issues with your tax withholding.

The W-4 form can vary from year to year, as tax regulations and laws change. It’s essential to use the correct version of the form for the appropriate tax year. Make sure you are aware of any updates or changes to the W-4 form for the current tax year to avoid any discrepancies or issues with your tax withholding.

Federal W-4 Form 2022 - W4 Form 2022 Printable

If you’re looking for a printable version of the W-4 form for the year 2022, you can easily find it online. Make sure to download and print the form from a trusted source, such as the official IRS website or other reliable tax resources. Having a printable version of the form can make it easier for you to fill it out accurately.

If you’re looking for a printable version of the W-4 form for the year 2022, you can easily find it online. Make sure to download and print the form from a trusted source, such as the official IRS website or other reliable tax resources. Having a printable version of the form can make it easier for you to fill it out accurately.

Tax Information · Career Training USA · InterExchange

When it comes to taxes, it’s always helpful to have access to reliable information and resources. The Career Training USA program by InterExchange provides valuable tax information to participants. They offer guidance and support to individuals navigating the complexities of the tax system.

When it comes to taxes, it’s always helpful to have access to reliable information and resources. The Career Training USA program by InterExchange provides valuable tax information to participants. They offer guidance and support to individuals navigating the complexities of the tax system.

Printable W 4 Form Alabama - Printable Forms Free Online

Each state may have its own specific tax requirements and forms. If you reside in Alabama, you can find a printable version of the W-4 form specific to the state. It’s important to use the correct form for your state to ensure accurate tax withholding.

Each state may have its own specific tax requirements and forms. If you reside in Alabama, you can find a printable version of the W-4 form specific to the state. It’s important to use the correct form for your state to ensure accurate tax withholding.

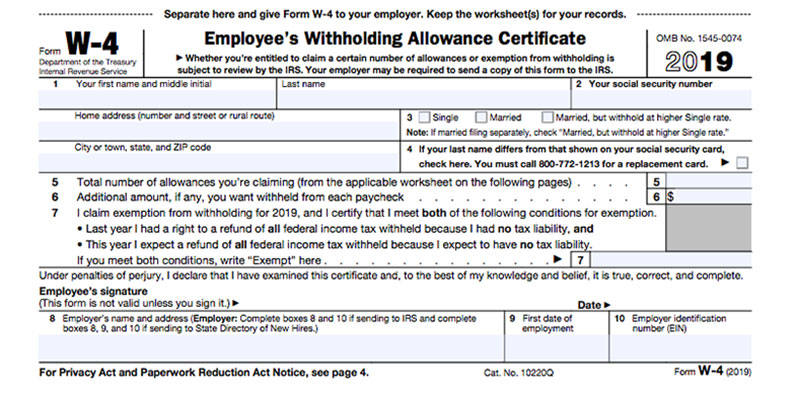

2020 Federal W 4 Forms Printable - 2022 W4 Form

If you’re looking for 2020 federal W-4 forms that are printable, you can easily find them online. It’s crucial to note that tax laws and forms can change from year to year. Therefore, it’s essential to use the correct form for the tax year you’re filing for to avoid any issues with your tax withholding.

If you’re looking for 2020 federal W-4 forms that are printable, you can easily find them online. It’s crucial to note that tax laws and forms can change from year to year. Therefore, it’s essential to use the correct form for the tax year you’re filing for to avoid any issues with your tax withholding.

Mass W 4 Form 2023 - Printable Forms Free Online

If you reside in Massachusetts and need to file a W-4 form, you can find a printable version of the form online. It’s important to refer to the specific instructions provided by the Massachusetts Department of Revenue to ensure that you accurately fill out the form and meet all state tax requirements.

If you reside in Massachusetts and need to file a W-4 form, you can find a printable version of the form online. It’s important to refer to the specific instructions provided by the Massachusetts Department of Revenue to ensure that you accurately fill out the form and meet all state tax requirements.

Il W 4 2020 - 2022 W4 Form

If you’re a resident of Illinois, you can find a printable version of the W-4 form specific to the state. It’s crucial to follow the instructions provided by the Illinois Department of Revenue to ensure that you accurately fill out the form and comply with all state tax regulations.

If you’re a resident of Illinois, you can find a printable version of the W-4 form specific to the state. It’s crucial to follow the instructions provided by the Illinois Department of Revenue to ensure that you accurately fill out the form and comply with all state tax regulations.

Xmlgregoriancalendar Example 2024 Cool Top The Best Famous | February

When it comes to taxes, staying informed and aware of the latest updates is crucial. It’s essential to consult reliable sources and resources when filling out tax forms. Keeping yourself educated and up to date will help ensure that you accurately complete your tax documents and meet all necessary requirements.

When it comes to taxes, staying informed and aware of the latest updates is crucial. It’s essential to consult reliable sources and resources when filling out tax forms. Keeping yourself educated and up to date will help ensure that you accurately complete your tax documents and meet all necessary requirements.

In conclusion, understanding and correctly filling out the W-4 form is essential to ensure accurate tax withholding from your paycheck. Utilizing printable versions of the W-4 form can make the process more convenient and allow you to keep your own records. Remember to always use the correct version of the form for the applicable tax year and consult reliable resources for up-to-date tax information.